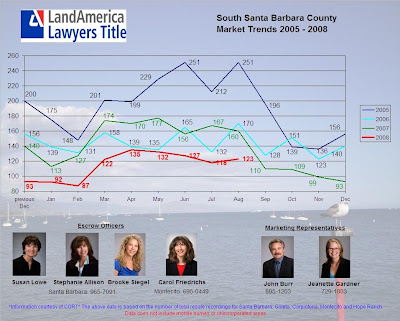

It is that time of month again when I'm able to map out all the home and property sales that happened in the Santa Barbara, Goleta, Montecito, and Carpinteria areas.

Consistency is once again the theme, 123 sales but there was one biggie. A piece of property on Cima Del Mundo sold for $26,400,000 as reported by CORT. I sure would like to have a look at that property. Maybe Google Earth will give me a shot. Better yet I found a photo tour you can view if you would like. That is a nice house!

The next biggest sale for August was 34 W. Victoria, which if memory serves me right is the Vons site at the corner of Chapala and Victoria. That sold for $12,500,000. I wonder if the new owners have some sort of plans for that location.

Goleta real estate appears to be continuing to hang in there. A property at 611 Corte Bella sold for $2,050,000 in August when a property earlier in the year on that same street sold for just under $2,000,000. It is interesting to see a number of properties selling below $750,000.

Carpinteria real estate is continuing to do what you would expect in this market. The sleepy little seaside surf town had 10 properties sell for well under 1 million. As a matter of fact a number of those properties went for under 500k.

Montecito had a solid month with quite a few properties in the 2-4 million dollar range selling.

Santa Barbara had a number of sales as well, with the median price being in the mid 900's. There were a number of sales over the $2,000,000 number with 1732 Santa Barbara St. going for $3,850,000.

I'm sure there were many sales you may be interested in looking up yourself, so don't hesitate to use the map below to quell your curiosity.

Goleta Council, Community Recognize Roger Aceves for 16 Years of Service to

City

-

He is the longest-serving council member in city history and has never

missed a meeting; his term officially ends on Dec. 20

2 years ago