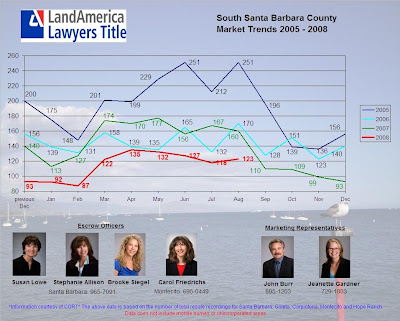

The number of transactions in Santa Barbara and the surrounding communities have been showing some signs of improvement recently. March and April showed improvement from the previous month. I was thinking this trend might continue. I was wrong, but not that wrong.

May had 132 properties sell compared to the 135 properties in April. So, if you ask me that is about the same.

I'm trying to save face here. It is interesting that the numbers are almost exactly the same for April and May in 2006.

Do I have a prediction for June? I suspect June is going to be down from May's number. With the Memorial Day Holiday and school graduations buyers seem to be distracted and we haven't seen an increase in the escrows we have been opening.

I have broken down the Santa Barbara area in to 4 different communities, Santa Barbara, Goleta, Montecito, & Carpinteria/Summerland.

In Santa Barbara proper there was an 18% drop in the number of transactions. In April CORT reported 65 transactions and May saw only 53. The highest priced property was on Marina Dr. and sold for 6,195,000. There were a number of low end properties that closed during May, most of them condominiums.

The numbers reported for Goleta showed another story. There was an 80% increase in the number of transactions. That is one short of the highest number of transactions in the last 3 years. The lowest priced property was an affordable unit on Via Lee which sold for $129,000. The highest priced property in Goleta was an Industrial Building on Castilian Dr. for $4,000,000

The Montecito market continues to remain healthy.

I think any time you report over 20 sales in Montecito that is a good number. There were 23 transactions that closed, which was a drop from April, but April's number was 32, which is a very significant number. The highest priced sale CORT had for Montecito was reported as 351 & 363 Woodley Rd. for $10,500,000. There were 3 other properties reported sold over 5 million, which is pretty normal for Montecito.

The 9 sales in Carpinteria/Summerland show no real significant change in that area. Some would argue that the property on Freehaven which sold for $8,750,000 is actually in Montecito, but CORT reported it in Summerland. There was one other significant sale reported in Carpinteria on Sandyland Rd. for $3,950,000.

After reviewing the different sub markets that make up the South Coast of Santa Barbara I find it very refreshing to see such a large number of sales in the Goleta area. This is one of the more affordable areas of our community and to see improvement in that market is exciting and if it can continue it will truly be a good stimulus for all the areas on the South Coast.

To get specifics on all the sales that happened on the South Coast for May you can review our

property sales map. For maps covering the rest of Santa Barbara County you can visit

The Santa Barbara Real Estate Blog. Links to these maps and maps for previous months are along the right hand side of the blog under property sales maps. One last note, CORT is short for Computer Oriented Real Estate Data and is a local company that reports property sales information.

May had 132 properties sell compared to the 135 properties in April. So, if you ask me that is about the same. I'm trying to save face here. It is interesting that the numbers are almost exactly the same for April and May in 2006.

May had 132 properties sell compared to the 135 properties in April. So, if you ask me that is about the same. I'm trying to save face here. It is interesting that the numbers are almost exactly the same for April and May in 2006. I have broken down the Santa Barbara area in to 4 different communities, Santa Barbara, Goleta, Montecito, & Carpinteria/Summerland.

I have broken down the Santa Barbara area in to 4 different communities, Santa Barbara, Goleta, Montecito, & Carpinteria/Summerland.